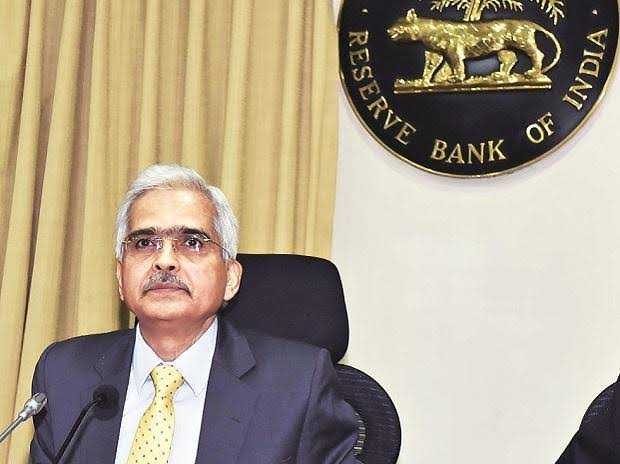

The Reserve Bank of India (RBI) finally bit the bullet on Friday and responded to the coronavirus-induced crisis with a whopping 75 basis points cut in the repo rate, bringing it down to 4.4 per cent. The central bank also cut the cash reserve ratio or CRR by 100 basis points to 3 per cent with effect from March 28, unlocking Rs 1.37 lakh crore primary liquidity in the banking system. The reverse repo rate, too, was lowered by 90 basis points.

The Reserve Bank of India (RBI) finally bit the bullet on Friday and responded to the coronavirus-induced crisis with a whopping 75 basis points cut in the repo rate, bringing it down to 4.4 per cent. The central bank also cut the cash reserve ratio or CRR by 100 basis points to 3 per cent with effect from March 28, unlocking Rs 1.37 lakh crore primary liquidity in the banking system. The reverse repo rate, too, was lowered by 90 basis points.

139.jpeg)

260.jpeg)

259.jpeg)

258.jpeg)